Non-performing loans may increase as recovery remains slow

Loans to the vulnerable sectors in Bangladesh such as garment, textile, cement and tanneries will face significant pressure as they are yet to record expected recovery from the shock of the coronavirus pandemic, Moody’s said.

“The true asset quality of loans will emerge across all sectors, and we expect significant pressure in loans to vulnerable sectors such as readymade garment and textile,” said the global credit rating agency in an analysis.

Garment and textile sectors accounted for 19.4 per cent of banking system loans at the end of 2019. In the nine months to September, garment-related exports fell by 19.8 per cent from the year-earlier period, according to export data.

Between July and January, the first seven months of the fiscal year, the shipment of garment declined 3.44 per cent year-on-year to $18.40 billion as Bangladesh’s key export destinations have been struggling to contain the impacts of the pandemic for more than a year, data from the Export Promotion Bureau showed.

Of the earnings from the apparel export, $9.98 billion came from the knitwear shipment, which was up 3.84 per cent. The export of woven items declined 10.85 per cent to $8.41 billion.

“We also expect loans in sectors such as cement manufacturing and tanneries to contribute to asset-quality stress because they have yet to recover from the economic slowdown,” Moody’s further.

The analysis said non-performing loans would increase in the next quarters because of the expiration of credit moratorium period and weakening of the repayment capacity of borrowers as a result of the coronavirus crisis.

“We expect the system-wide NPL ratio to increase in the coming quarters.”

On January 31, the central bank announced that it would not extend the loan repayment moratorium that was introduced after the start of the coronavirus outbreak in March. Instead, the central bank allowed banks to extend the repayment period for term loan instalments for up to two years.

“The extent of NPL formation will, however, depend on banks’ willingness to extend loan repayment periods and the effectiveness of the stimulus measures announced last year,” Moody’s said.

As much as 70 per cent of the total outstanding loans amounting to BDT 1,063,626 crore or EUR 106.36 bln were term loans as of September 30 last year, according to the central Bank of Bangladesh.

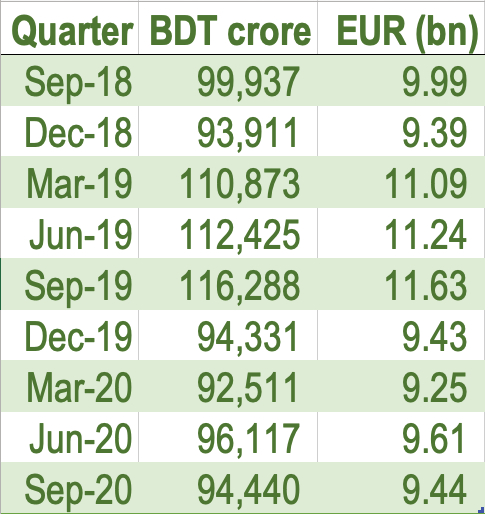

NPLs stood at BDT 94,440 crore or EUR 9.44 bln as of September, the latest for which data is available. This is down 1.74 per cent from three months earlier and 18.73 per cent year-on-year.

The NPL declined to 8.9 per cent in September from 12 per cent a year earlier despite disruptions caused by the coronavirus pandemic.

“The decline was driven by the loan moratorium and the prohibition on banks downgrading loans until December 2020, which delayed the recognition of NPLs,” the credit rating agency said.

The actual picture of defaulted loans would be more apparent in the middle of 2021 when the moratorium facility will not be available, said Mr. MA Halim Chowdhury, Managing Director of Pubali Bank, in December.

The toxic loans would go up at a faster pace once the moratorium is lifted, said Dr. Ahsan H. Mansur, Executive Director of the Policy Research Institute of Bangladesh, earlier.

The extension of loan tenure – a type of loan rescheduling – is credit positive because it will reduce the risk of a sudden surge in NPL ratios, Moody’s said.

With the expiry of the moratorium, borrowers face higher monthly instalments because the maturities remain the same, resulting in amortisation of loan balances over a shorter period.

“The loan tenure extension will alleviate pressure on borrowers because they will have up to an additional two years to make repayments.”

The agency said the moratorium’s end was also credit positive because it restored transparency and payment discipline in the banking system, ensuring the comparability of asset quality between banks.

It will allow banks to identify those borrowers that are truly affected by the economic slowdown and those that are wilful defaulters.

In addition, revealing the extent of asset-quality problems will provide regulators with more visibility on the financial health of the banking system and enable implementation of effective support measures, it said.